Dominating Your Cash: The Fundamental Manual for Overseeing Individual accounting records

Overseeing individual accounting records is a fundamental expertise for accomplishing monetary solidness and getting your future. This far reaching guide offers significant experiences and commonsense tips for successfully dealing with your cash. It covers making a financial plan, putting something aside for the future, overseeing obligation, and anticipating retirement, enabling you to assume responsibility for your individual budgets and pursue informed monetary choices.

**Understanding the Significance of Overseeing Individual Finances**

Investigate the meaning of overseeing individual budgets, which incorporates monetary security, decreased pressure, and the capacity to accomplish monetary objectives. Perceive how viable monetary administration adds to long haul abundance aggregation and the significance of developing sound monetary propensities.

**Making a Spending plan for Compelling Monetary Planning**

Figure out how to make a thorough spending plan that precisely mirrors your pay, costs, and monetary goals. Track your spending, focus on fundamental costs, and distinguish regions where you can scale back. Dispense assets for investment funds, obligation reimbursement, and optional spending to support a decent monetary arrangement.

**Saving and Contributing for Future Monetary Security**

Devise a reserve funds system to lay out a secret stash for unexpected costs. Investigate different speculation choices \x1 like stocks, securities, or shared reserves \x1 to develop your abundance after some time. Understand the ideas of chance and award, and look for proficient direction as required.

**Overseeing Obligation and Credit Responsibly**

Procure powerful obligation the board methodologies to lighten monetary pressure. Center around focusing on obligation reimbursement, offering more than the base installment, and thinking about the combination of exorbitant interest obligations. Figure out credit elements, keep serious areas of strength for a score, and exercise dependable Visa use.

**Laying out Brilliant Spending Habits**

Develop careful ways of managing money by separating among needs and needs. Pursue informed buying decisions, take part in examination shopping, and stay away from hasty purchases. Consider methodologies like the 24-hour rule or making a spending intend to assist with forestalling pointless costs.

**Building a Backup stash for Startling Expenses**

Recognize the need of a secret stash as a monetary wellbeing net. Dispense a part of your pay routinely to construct a hold for surprising expenses, for example, health related crises or vehicle fixes. Mean to save three to a half year of everyday costs in your secret stash.

**Making arrangements for Retirement and Long haul Monetary Goals**

Start retirement arranging right on time to use build interest and secure an agreeable future. Research retirement reserve funds choices, for example, manager supported plans or individual retirement accounts (IRAs). Set long haul monetary goals, such as buying a home or subsidizing schooling, and devise an arrangement to achieve them.

Successfully overseeing individual budgets is a basic expertise for accomplishing monetary security and accomplishing your monetary desires. By following this basic aide, you will acquire experiences into the significance of individual accounting the board, make a powerful financial plan, use your reserve funds and speculations shrewdly, oversee obligation dependably, lay out astute ways of managing money, assemble a backup stash, and plan for retirement and long haul monetary objectives. Immediately jump all over the chance to assume command over your monetary future and establish the groundwork for a solid and prosperous life.

**Understanding the Significance of Overseeing Individual Finances**

Investigate the meaning of overseeing individual budgets, which incorporates monetary security, decreased pressure, and the capacity to accomplish monetary objectives. Perceive how viable monetary administration adds to long haul abundance aggregation and the significance of developing sound monetary propensities.

**Making a Spending plan for Compelling Monetary Planning**

Figure out how to make a thorough spending plan that precisely mirrors your pay, costs, and monetary goals. Track your spending, focus on fundamental costs, and distinguish regions where you can scale back. Dispense assets for investment funds, obligation reimbursement, and optional spending to support a decent monetary arrangement.

**Saving and Contributing for Future Monetary Security**

Devise a reserve funds system to lay out a secret stash for unexpected costs. Investigate different speculation choices \x1 like stocks, securities, or shared reserves \x1 to develop your abundance after some time. Understand the ideas of chance and award, and look for proficient direction as required.

**Overseeing Obligation and Credit Responsibly**

Procure powerful obligation the board methodologies to lighten monetary pressure. Center around focusing on obligation reimbursement, offering more than the base installment, and thinking about the combination of exorbitant interest obligations. Figure out credit elements, keep serious areas of strength for a score, and exercise dependable Visa use.

**Laying out Brilliant Spending Habits**

Develop careful ways of managing money by separating among needs and needs. Pursue informed buying decisions, take part in examination shopping, and stay away from hasty purchases. Consider methodologies like the 24-hour rule or making a spending intend to assist with forestalling pointless costs.

**Building a Backup stash for Startling Expenses**

Recognize the need of a secret stash as a monetary wellbeing net. Dispense a part of your pay routinely to construct a hold for surprising expenses, for example, health related crises or vehicle fixes. Mean to save three to a half year of everyday costs in your secret stash.

**Making arrangements for Retirement and Long haul Monetary Goals**

Start retirement arranging right on time to use build interest and secure an agreeable future. Research retirement reserve funds choices, for example, manager supported plans or individual retirement accounts (IRAs). Set long haul monetary goals, such as buying a home or subsidizing schooling, and devise an arrangement to achieve them.

Successfully overseeing individual budgets is a basic expertise for accomplishing monetary security and accomplishing your monetary desires. By following this basic aide, you will acquire experiences into the significance of individual accounting the board, make a powerful financial plan, use your reserve funds and speculations shrewdly, oversee obligation dependably, lay out astute ways of managing money, assemble a backup stash, and plan for retirement and long haul monetary objectives. Immediately jump all over the chance to assume command over your monetary future and establish the groundwork for a solid and prosperous life.

LATEST POSTS

- 1

4 Creative Savvy Home Gadgets of 2024: Reforming Home Robotization and Security

4 Creative Savvy Home Gadgets of 2024: Reforming Home Robotization and Security - 2

Mobility exercises are an important part of fitness as we age. Here are some tips

Mobility exercises are an important part of fitness as we age. Here are some tips - 3

SpaceX launches Starlink satellites on its 150th Falcon 9 mission of the year

SpaceX launches Starlink satellites on its 150th Falcon 9 mission of the year - 4

Qatar, Ireland accuse Israel of using chemical weapons on Palestinians, demand watchdog probe use

Qatar, Ireland accuse Israel of using chemical weapons on Palestinians, demand watchdog probe use - 5

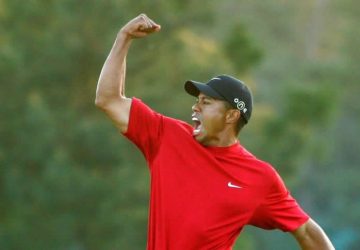

The 10 Most Significant Games in History

The 10 Most Significant Games in History

Share this article

The most effective method to Succeed in Your Web based Advertising Degree: Procedures for Progress

The most effective method to Succeed in Your Web based Advertising Degree: Procedures for Progress U.S. to drop childhood vaccine recommendations as it looks to Denmark, Washington Post reports

U.S. to drop childhood vaccine recommendations as it looks to Denmark, Washington Post reports The 25 Most Notable Style Crossroads in History

The 25 Most Notable Style Crossroads in History From record warming to rusting rivers, 2025 Arctic Report Card shows a region transforming faster than expected

From record warming to rusting rivers, 2025 Arctic Report Card shows a region transforming faster than expected Doggie diversity in size and shape began at least 11,000 years ago

Doggie diversity in size and shape began at least 11,000 years ago The Tradition of Stone: A Gander at Notable Structures Through the Ages

The Tradition of Stone: A Gander at Notable Structures Through the Ages When preventable infections turn deadly behind bars | The Excerpt

When preventable infections turn deadly behind bars | The Excerpt 5 Great and High Evaluated Scene Configuration Administrations For 2024

5 Great and High Evaluated Scene Configuration Administrations For 2024 Check out the exclusive pitch deck Valerie Health used to raise $30 million from Redpoint Ventures to automate healthcare faxes

Check out the exclusive pitch deck Valerie Health used to raise $30 million from Redpoint Ventures to automate healthcare faxes